michigan use tax exemption form

All claims are subject to. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

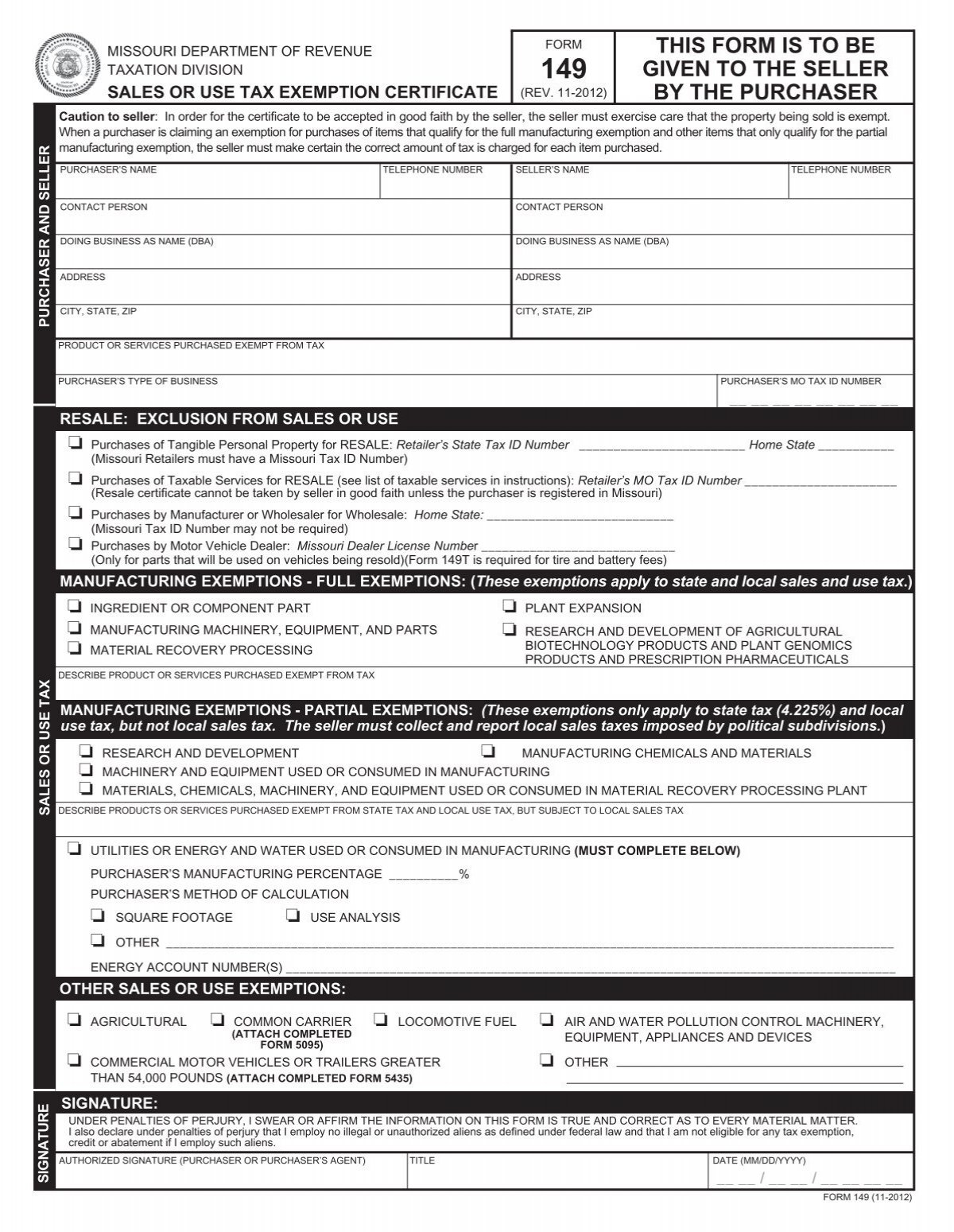

Form 149 Sales And Use Tax Exemption Certificate Missouri

All claims are subject to.

. Apply for or renew permit or certification. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Property Tax Exemptions Property Tax Forfeiture and Foreclosure.

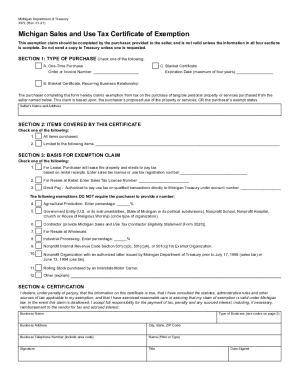

Purchasers may use this form to claim exemption from Michigan sales and use tax on qualifi ed transactions. All claims are subject to audit. How do I obtain a tax exempt number to claim an exemption from Sales or Use Tax.

This claim is based upon. Do Business with the City. If you are looking to purchase goods in Michigan and you have tax-exempt status you need to fill out this form and present it to the seller at the time of your purchase.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used to claim exemption from Michigan Sales and Use Tax. Currently there is no computation validation or verification of the information you enter and. Pay fine bill or tax.

Get Access to the Largest Online Library of Legal Forms for Any State. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Present a copy of this certificate to suppliers when you wish to purchase items for resale.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. 2021 Michigan Business Tax Forms Back Corporate Income Tax Back Sales and Use Tax Information. If you received a Letter of Inquiry Regarding Annual Return for the return period of 2020 visit MTO to file or access the 2020 Sales Use and Withholding Taxes Annual Return fillable form.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Apply for or renew license. Seller s Name and Address.

Fillable Forms Disclaimer. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. All claims are subject to audit.

The buyer must present the seller with a completed form at the time. Michigan Department of Treasury Form 3372 Rev. All claims are subject to audit.

Ad Powerful Forms Database software. Integrate Your Data into Forms for Faster Data Entry. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from the.

If you received a Letter of Inquiry Regarding Annual Return for the return period of 2021 visit MTO to file or 2021 Sales Use and Withholding Taxes Annual Return to access the fillable form. OR the purchaser s exempt status. Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be.

Michigan does not issue tax-exempt numbers so sellers must have this form in order for you to be granted your. All claims are subject to audit. Fillable Forms Disclaimer.

All fields must be. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. For other Michigan sales tax exemption certificates go here.

2020 Sales Use and Withholding 4 and 6 MonthlyQuarterly and Amended MonthlyQuarterly Worksheet. The Michigan Department of Treasury does not issue tax exempt numbers. The purchasers proposed use of the property or services.

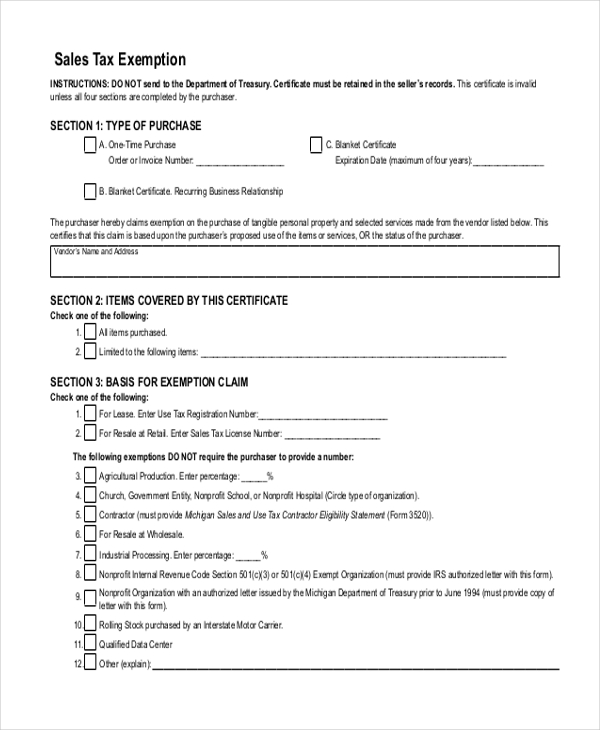

Certificate must be retained in the Sellers Records. Sellers should not accept a number as evidence of exemption from sales or use. Fill out the Michigan 3372 tax exemption certificate form.

Create forms in Minutes. Currently there is no computation validation or verification of the information you enter and. All fields must be.

08-12 Michigan Sales and Use Tax Certifi cate of Exemption. This box only if the property owner is qualified under the regional convention facility authority act pursuant to the Michigan Sales and Use Tax Acts MCL 20554dm and MCL 20594 z. Report of Fuel Sales Tax Prepayment and Environmental Protection Regulatory Fee for Refiners Terminal Operators and Importers.

Many tax forms can now be completed on-line for printing and mailing. Many tax forms can now be completed on-line for printing and mailing. Notice of Change or Discontinuance.

11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury. Apps work offline Integrate data Rules Calcs Dispatch PDF. Obtain a Michigan Sales Tax License.

Ad The Leading Online Publisher of Michigan-specific Legal Documents. New State Sales Tax Registration. Michigan does not issue tax exemption numbers.

Authorized Representative DeclarationPower of Attorney. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions. It to the contractor who will submit this form to the supplier along with Michigans Sales and Use Tax Certificate of Exemption form 3372 at the time of.

Therefore you can complete the 3372 tax exemption certificate form by providing your Michigan Sales Tax Number. Ad Fill Sign Email MI DoT 3372 More Fillable Forms Register and Subscribe Now. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. All claims are subject to audit. Ad Mi Tax Exemption Form information registration support.

Find or apply for employment. However if provided to the purchaser in electronic format a signature is not required. However if provided to the purchaser in electronic format a signature is not required.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. How to use sales tax exemption certificates in Michigan.

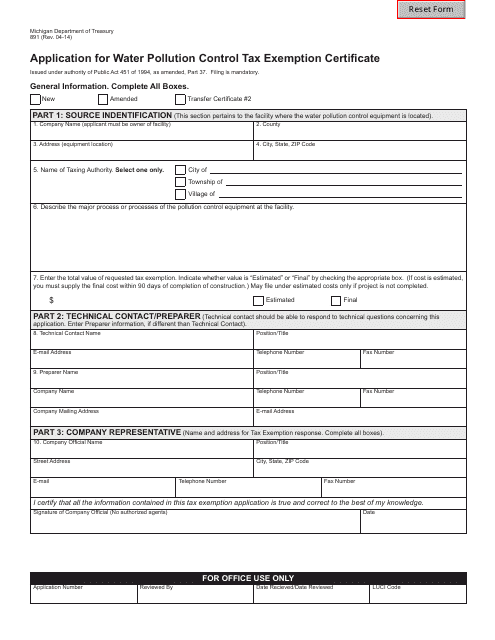

Form 891 Download Fillable Pdf Or Fill Online Application For Water Pollution Control Tax Exemption Certificate Michigan Templateroller

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

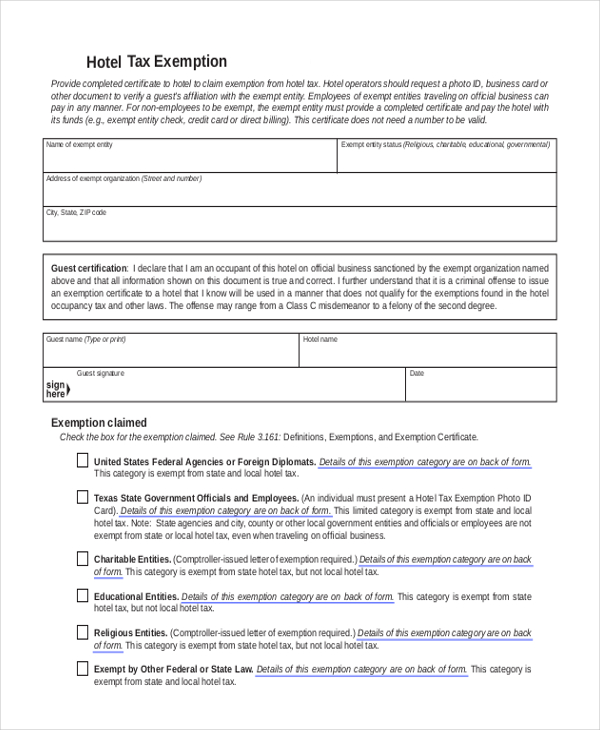

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Michigan Resale Certificate Fill Out And Sign Printable Pdf Template Signnow

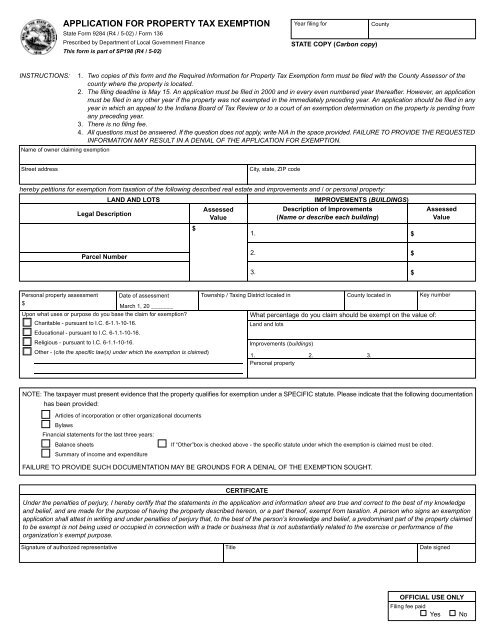

Form 136 Application For Property Tax Exemption

Download Policy Brief Template 40 Brief Executive Summary Ms Word

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Michigan Sales And Use Tax Certificate Of Exemption

Mi Dot 3372 2021 2022 Fill Out Tax Template Online Us Legal Forms

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller